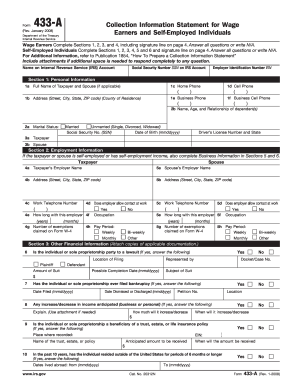

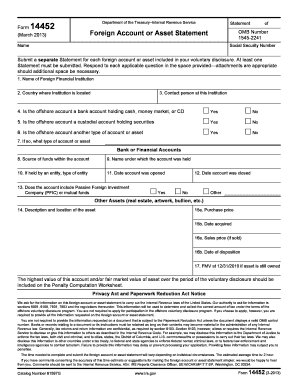

IRS Form 13711 2009 free printable template

Show details

Name of authorized representative Signature of authorized representative Telephone number of authorized representative Best time to call Form 13711 Rev. 6-2009 Cat. No. 40992F www.irs.gov Department of the Treasury - Internal Revenue Service.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Form 13711

Edit your IRS Form 13711 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Form 13711 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Form 13711 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS Form 13711. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Form 13711 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Form 13711

How to fill out IRS Form 13711

01

Download IRS Form 13711 from the IRS website or request a physical copy.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of tax return you are disputing by checking the appropriate box.

04

Write a detailed explanation of why you believe the IRS's decision is incorrect in the section provided.

05

Attach any supporting documentation that backs up your claim, such as tax returns or correspondence from the IRS.

06

Sign and date the form to certify that the information provided is true and complete.

07

Mail the completed form to the address indicated in the instructions for IRS Form 13711.

Who needs IRS Form 13711?

01

Anyone who disagrees with the IRS's determination regarding their tax situation and wants to request reconsideration.

Fill

form

: Try Risk Free

People Also Ask about

How long does the IRS have to respond to an offer in compromise?

You make all required payments per your offer. You don't have to make payments on an existing installment agreement. Your offer is automatically accepted if the IRS doesn't not make a determination within two years of the IRS receipt date (This does not include any Appeal period.)

How long does it take to appeal an offer in compromise?

If you received a letter notifying you that the IRS rejected your offer, you have 30 days from the date of the OIC rejection letter to request an appeal of the decision. If it's been more than 30 days from the date of the rejection letter, your appeal won't be accepted.

Will the IRS accept my offer in compromise?

For the IRS to accept an offer, you must file all tax returns due and be current with estimated tax payments or withholding. If you own a business and have employees, you must file all returns and be current on all your federal tax deposits. NOTE: If you or your business is currently in an open bankruptcy.

How the IRS decides to accept or reject an offer in compromise?

In most cases, the IRS won't accept an OIC unless the amount offered by a taxpayer is equal to or greater than the reasonable collection potential (RCP). The RCP is how the IRS measures the taxpayer's ability to pay.

How much should I Offer in Compromise to the IRS?

There are 2 basic Offer in Compromise formulas: On a 5-month repayment plan: (Available Monthly Income x 12) + Value of Personal Assets. On a 24-month repayment plan: (Available Monthly Income x 24) + Value of Personal Assets.

Why would offer in compromise be rejected?

A bankruptcy filing, failure to include the entire application fee, missing information, additional liabilities being accrued while the offer is being considered, and many other things may all cause your offer in compromise to be returned.

How long does an Offer in Compromise appeal take?

Processing times vary, but you can expect the IRS to take at least six months to decide whether to accept or reject your Offer in Compromise (OIC). The process can take much longer if you have to dispute the examiner's findings or appeal their decision.

How long does OIC take to process?

Most OICs take between 7 and 12 months to complete, which means the taxpayers would send 7 to 12 monthly payments to the IRS. These payments can be considerable, and there's no guarantee that the IRS will accept the OIC.

How many times can you submit an offer in compromise to the IRS?

One can submit more than one Offer in Compromise for consideration by the IRS. There is no minimum wait time between Offer submissions.

How do I get the IRS to accept an Offer in Compromise?

First, the IRS can accept a compromise if there is doubt as to liability. A compromise meets this criterion only when there's a genuine dispute as to the existence or amount of the correct tax debt under the law. Second, the IRS can accept a compromise if there is doubt that the amount owed is fully collectible.

What happens if my Offer in Compromise is rejected?

If you received a letter notifying you that the IRS rejected your offer, you have 30 days from the date of the OIC rejection letter to request an appeal of the decision. If it's been more than 30 days from the date of the rejection letter, your appeal won't be accepted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Form 13711 for eSignature?

IRS Form 13711 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out IRS Form 13711 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IRS Form 13711 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit IRS Form 13711 on an Android device?

You can make any changes to PDF files, such as IRS Form 13711, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is IRS Form 13711?

IRS Form 13711 is a form used by taxpayers to request a reconsideration of an IRS decision regarding an examination or audit of their tax return.

Who is required to file IRS Form 13711?

Taxpayers who disagree with the findings of the IRS after an audit and wish to contest the decision are required to file IRS Form 13711.

How to fill out IRS Form 13711?

To fill out IRS Form 13711, taxpayers must provide their personal information, a detailed explanation of why they disagree with the IRS's findings, and any supporting documents or evidence that substantiate their claims.

What is the purpose of IRS Form 13711?

The purpose of IRS Form 13711 is to allow taxpayers to formally request a review and reconsideration of an IRS audit or examination decision that they believe is incorrect.

What information must be reported on IRS Form 13711?

Information that must be reported on IRS Form 13711 includes the taxpayer's name, address, tax identification number, details of the audit findings being contested, and a statement of the reasons for the disagreement along with any relevant documentation.

Fill out your IRS Form 13711 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Form 13711 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.